Forming a Business

Are you forming a new business? The first bit of advice is to do your homework. Going into business is a significant investment of time, money, and resources. You want to make sure that you’ve done a thorough job of researching the market to make sure that there is a viable market potential to do well in your prospective field. You have to plan every step of the way. Financial planning is of utmost importance as everything in your business will require money to get started. We call those initial expenses, start-up costs.

If your business requires supplies, you’ll have to budget for that. If your business needs office space, that’ll have to be included as well. Your location may matter depending on the time of business you have and who your target customers might be. Most companies will be required to obtain state licenses and permits to operate legally. Choosing the right accounting system is crucial. There are so many different accounting systems available, some that are very expensive, others more affordable. You have to get the software package that works within your budget and serves your business needs.

One of the most common mistakes thousands of new start business owners make is that they form their business structure improperly, particularly when they’ve not consulted a professional in this area. How you establish your business will determine how taxes and filings are done and when they are needed to be filed. The four main types of business structures are: sole proprietorship, also known as individual entrepreneurship, is an enterprise run by one person. For the most part, the business owner and the business itself are perceived as one entity.

In a partnership, business partners, at least two, agree to cooperate to advance their mutual interests. The partners are often expected to share most of the expenses as they’re also likely to have an equal share in the profits or whatever share that has been determined at the point of their written agreements. A limited liability (LLC) is a business structure, whereas the owners are not personally liable for the company’s debts or liabilities.

A corporation is a type of business that declares the company as a separate, legal entity, commonly guided by a group of officers called the board of directors. For many companies with expectations of growing large and which may have slightly higher potential liabilities, this form may be the most advantageous way to go. The two types of corporations are an S and C corporation. Each structure has different tax, income, and liability implications for business owners and their companies. So, it is essential to get sound advice on the right one to choose from the start. Nothing But Numb3rs is pleased to help you choose the right fit for you and your needs.

Nonprofits

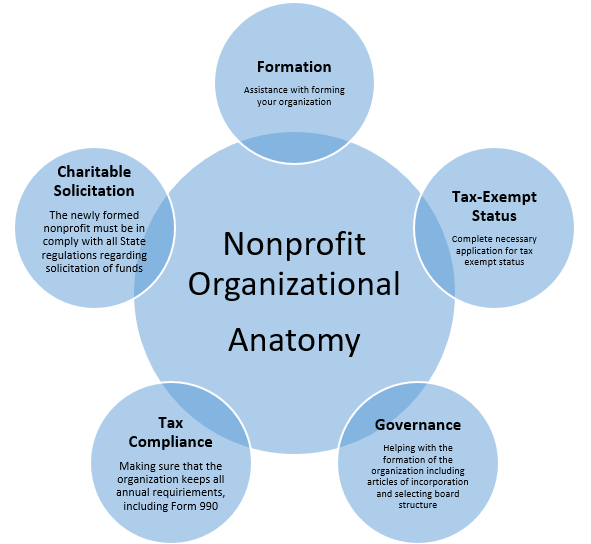

When forming a nonprofit organization, some specifics must be done for your filing to be accepted and approved by the Internal Revenue Service. Far too many good-hearted individuals start the timely process of becoming a nonprofit only to discover that they missed important information that caused them to be denied altogether. This doesn’t have to be the case. Each nonprofit is unique to why it exists. There are AAU nonprofits, homeless shelter nonprofits, food kitchen for the homeless nonprofits, children educational nonprofits, and health initiative nonprofits.

Depending on the nonprofit and the demographic whom they serve and the mission of the nonprofit, the government will either approve or deny it based on its relevancy. That’s where we come in. We walk you through each step of the process, from helping you to choose the right name that fits your mission to create your articles of incorporation. We secure your IRS tax identification EIN and help you to draft your bylaws. We’ll show you how to choose a board and appoint directors.

Connecticut Scholars (AAU)

www.ctscholars.org

Minority Inclusion Project

https://ctmip.org/

Dynamic Essentials (D.E.) Lasting Purpose Foundation

https://www.lifede.com/about

Connecticut Takeover (AAU)

https://www.cttakeover.com/

The Scribe’s Institute Inc.

https://thescribesinstitute.org/

Testimonial for JoAnna Laiscell – Nothing But Numb3rs

IIt has been a true blessing to have JoAnna Laiscell working alongside New Life II for the past two and a half years. As our nonprofit accountant, she has consistently demonstrated exceptional professionalism, integrity, and commitment to our mission. JoAnna’s expertise in nonprofit financials and grants management has been instrumental in helping us remain compliant, transparent, and fiscally sound as we grow and expand our services across Connecticut and beyond.

What sets JoAnna apart is not just her deep knowledge of nonprofit accounting, but her genuine care for the organizations she serves especially Black-led nonprofits like ours. She has become someone we trust wholeheartedly, and her attention to detail, clear communication, and proactive guidance have made her an invaluable part of our team.

We highly recommend JoAnna Laiscell and Nothing But Numb3rs to any nonprofit or small business looking for trustworthy, mission-aligned financial leadership. Her work ethic, character, and dedication speak volumes—and we are truly grateful to have her in our corner.

JoAnna Laiscell is a trusted, skilled professional who has been a vital part of New Life II’s financial growth and integrity.”

Pastor Dana Smith

Executive Director

New Life II

Contact Us

- 642 Hilliard Street Suite 2121 Manchester CT 06042

- (860) 869-5667

- joanna@nothinbutnumbers.com