Forming a Business

Are you forming a new business? The first bit of advice is to do your homework. Going into business is a significant investment of time, money, and resources. You want to ensure that you’ve researched the market thoroughly to ensure there is a viable market potential to do well in your prospective field. You have to plan every step of the way. Financial planning is paramount, as everything in your business will require money. We call those initial expenses start-up costs.

If your business requires supplies, you’ll have to budget for that. If your business needs office space, you must also include that. Your location may matter depending on the time of your business and who your target customers might be. Most companies must obtain state licenses and permits to operate legally. Choosing the right accounting system is crucial. So many accounting systems are available, some very expensive, others more affordable. You must get a software package that works within your budget and serves your business needs.

One of the most common mistakes thousands of new start business owners make is forming their business structure improperly, particularly when they’ve not consulted a professional in this area. How you establish your business will determine how you do taxes and filings and when you must file them. The four main types of business structures are sole proprietorship, also known as individual entrepreneurship and enterprise run by one person. Mostly, people perceive the business owner and the business itself as one entity.

In a partnership, business partners, at least two, agree to cooperate to advance their mutual interests. The partners are often expected to share most of the expenses as they’re also likely to have an equal share in the profits or whatever share that has been determined at the point of their written agreements. A limited liability (LLC) is a business structure, whereas the owners are not personally liable for the company’s debts or liabilities.

A corporation is a type of business that declares the company as a separate, legal entity, commonly guided by a group of officers called the board of directors. For many companies with expectations of growing large and which may have slightly higher potential liabilities, this form may be the most advantageous way to go. The two types of corporations are an S and C corporation. Each structure has different tax, income, and liability implications for business owners and their companies. So, it is essential to get sound advice on the right one to choose from the start. Nothing But Numb3rs is pleased to help you choose the right fit for you and your needs.

Nonprofits

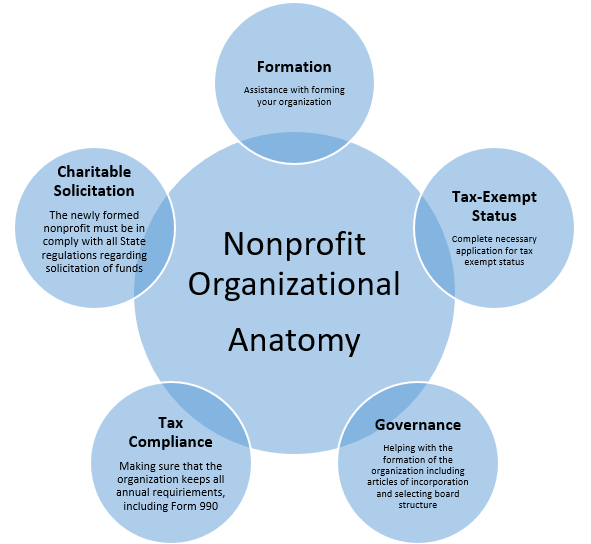

When forming a nonprofit organization, you must meet some specifics so that the Internal Revenue Service can accept and approve your filing. Far too many good-hearted individuals start the timely process of becoming a nonprofit only to discover that missing important information leads to denying their applications. This doesn’t have to be the case. Each nonprofit is unique in terms of why it exists. There are AAU nonprofits, homeless shelter nonprofits, food kitchens for the homeless nonprofits, children’s educational nonprofits, and health initiative nonprofits.

Depending on the nonprofit, the demographic it serves, and the mission of the nonprofit, the government will either approve or deny it based on its relevancy. That’s where we come in. We walk you through each step of the process, from helping you choose the right name that fits your mission to creating your articles of incorporation. We secure your IRS tax identification EIN and help you to draft your bylaws. We’ll show you how to choose a board and appoint directors.

From start to finish, we help you from inception to creation to managing your annual filings. Unlike for-profit corporations, which receive penalties for late filings, nonprofits must close if they do not file promptly. Get things off on the right foot and choose Nothing But Numb3rs to get your nonprofit started today. Tax expert Joanna Laiscell has formed and managed numerous thriving nonprofits. These are just a few of the organizations she helped to create.

Connecticut Scholars (AAU)

www.ctscholars.org

Minority Inclusion Project

https://ctmip.org/

Dynamic Essentials (D.E.) Lasting Purpose Foundation

https://www.lifede.com/about

Connecticut Takeover (AAU)

https://www.cttakeover.com/

The Scribe’s Institute Inc.

https://thescribesinstitute.org/

Contact Us

- 642 Hilliard Street Suite 2121 Manchester CT 06042

- (860) 869-5667

- joanna@nothinbutnumbers.com